The Open Liquidity Network Manifesto

Abstract

We explore the common misconception of comparing blockchain interoperability protocols to the TCP/IP standard, highlighting the unique challenges and dynamics of the cryptoeconomy. We then advocate for the adoption of open token standards, specifically the xERC family, to enable asset sovereignty across ecosystems via the Open Liquidity Network.

Interoperability Protocols ≠ TCP/IP

Many blockchain interoperability protocols advertise themselves as equivalents to the TCP/IP networking standard. This is a fundamentally mistaken view due to the fact that today’s interoperability protocols make use of proprietary standards that are incompatible with one another.

Understanding TCP/IP

TCP/IP is a set of neutral protocols that enable computers to communicate over the internet by specifying how data should be packaged, addressed, transmitted, and routed across network boundaries. It was designed to be robust, flexible, and scalable. These properties made TCP/IP a perfect fit to connect heterogenous computer networks across the globe. Ultimately, this network of networks became the internet.

It is critical to understand that TCP/IP itself is nothing more than an open standard — a format for how we should collectively pass data between distinct networks. There is no privileged party that directly benefits every time a packet of data is transmitted through TCP/IP. As a vendor-neutral standard, TCP/IP was able to outcompete proprietary networking standards such as Novell’s IPX/SPX, Apple’s AppleTalk, and IBM’s SNA in the late 1980s / early 1990s. Ultimately, these vendors were forced to adopt TCP/IP for networking and compete on other dimensions like hardware and software applications.

Blockchain Interoperability Protocols

Today’s interoperability protocols are reminiscent of the proprietary networking solutions of the early 1980’s. Each provider offers a unique security framework and network connections. Currently, these interoperability solutions also use unique token standards on destination networks to compete on a liquidity dimension — this is where the analogy of interoperability protocols to TCP/IP breaks down.

At the end of the day, interoperability protocols have business models. There are inherent costs in the process of securing a cross chain message and protocols must generate revenue to offset this. A proprietary token standard serves as a mechanism for these protocols to compete with one another and to monetize their services in the future.

The prospect of becoming the dominant solution in this sector of the cryptoeconomy is very attractive and has driven heavy competition between protocols. The product is a system where assets are divided across a variety of token standards. This creates liquidity fragmentation, a poor developer experience, and results in users misunderstanding the risks tied to the specific asset they hold.

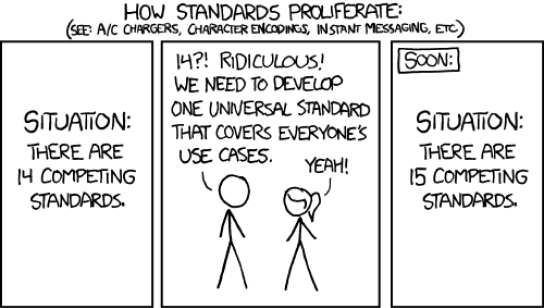

Under these current conditions, asset issuers must choose a single interoperability service provider to solve the fragmentation problem. Doing so requires the asset issuer to cede its sovereignty to the interoperability provider. So far, interoperability protocols have had little success convincing asset issuers to adopt their proprietary standards. This is due to the fact that unique market participants possess different risk profiles and interoperability providers carry their own tradeoffs in regards to security and integrations. Given these dynamics, we will continue to see a never ending stream of interoperability providers advertising themselves as the golden solution.

How Does xERC-20 Work?

Asset issuers can choose to deploy a new token natively as an xERC-20 token, just as they would deploy an ERC-20 token. Alternatively, existing ERC-20 tokens can be converted to the xERC-20 standard using a “Lockbox” contract. The Lockbox wraps tokens into the xERC-20 standard and returns them 1:1.

When deploying an xERC-20 or a Lockbox contract, asset issuers authorize bridge contracts to be added to a whitelist. To mitigate the negative impacts of bridge hacks, rate limits can be used to control the amount of tokens that may be minted by each bridge every day. The whitelisting and rate limiting settings can both be configured by the contract owner over time. Alternatively, the upgrade keys may be burned, thereby permanently freezing the list of authorized bridges and their respective rate limits.

Open Standards Unlock the Cryptoeconomy

Open standards are publicly accessible formats that create compatibility among various service providers without being tied to any specific vendor. An open token standard that can be used by distinct interoperability providers is the real equivalent of a TCP/IP moment for the cryptoeconomy. Under this new paradigm, asset issuers retain control over their token rather than ceding control to the interoperability service provider. Asset issuers can select which interoperability service providers they support for their token and force these service providers to compete on security, integrations, and user experience. The power is inverted from today’s reality.

History leads us to believe that this is how a multi-ecosystem cryptoeconomy will operate in the future. The adoption of TCP/IP in computer networking, SQL in relational database management, and WiFi in wireless network communications all provide examples of how open standards redefine digital industries. In fact, we have already seen this play out before with Ethereum.

ERCs — The First Token Standards

In the early days of Ethereum, tokens were implemented with a variety of functions and event triggers. This made it difficult for wallets, exchanges, and other smart contracts to interact with tokens in a consistent manner and capped the innovation that was possible on Ethereum.

The ERC-20 standard was created in 2015 to provide standardization for token implementations on Ethereum. Specifically, ERC-20 introduced a set of required functions event triggers that all compliant tokens must have. As an open standard, ERC-20 was publicly available and could be used by anyone. The standard was iteratively developed by the Ethereum community which fostered a sense of ownership and support among early Ethereum developers.

As more tokens adopted the ERC-20 standard, network effects began to kick in — it became increasingly advantageous for new tokens to also adopt ERC-20 and benefit from the previous integrations (wallets, exchanges, dApps) and interoperability with other ERC-20s.

In later years, we witnessed the same pattern play out with non-fungible tokens through the adoption of ERC-721. Together, these open token standards increased the composability of the entire Ethereum ecosystem and laid the groundwork for the advanced applications we enjoy today.

xERCs — Sovereign Bridged Token Standards

To solve the problem of fragmentation across blockchain ecosystems, we must extend existing open token standards to add support for interoperability protocols at the asset level. Luckily, the Ethereum community has already pioneered these standards under the xERC family.

Originally proposed by the Connext team in 2023, xERC-20 (EIP-7281) is an extension to the original ERC-20 token standard that adds bridge whitelisting and rate limiting features. More recently, Omni Network proposed the xERC-721 standard (EIP-7611) to add the same functionalities to ERC-721 tokens (the common standard used for NFTs). Bridge whitelisting allows assets to minimize their bridge risk while bridge rate limiting allows assets to limit the risk tied to any specific bridge. Each of these can be configured dynamically by the asset issuer.

Adopting xERC standards enables assets to move freely between different ecosystems without reliance on a single provider for interoperability. This fluid movement unifies the user experience and lays the foundation for an integrated developer experience.

The Open Liquidity Network

Omni Network is leading the adoption of the Open Liquidity Network, a community-driven approach to building an integrated ecosystem of assets using the xERC-20 and xERC-721 standards. The Open Liquidity Network represents asset issuers committed to changing the way interoperability is programmed into the cryptoeconomy. We expect network effects to form around the Open Liquidity Network that mirror the patterns seen with early ERC tokens, TCP/IP, and other neutral digital networking standards.

Contact us to learn more about the Open Liquidity Network and discover how you can benefit from this collaborative effort.